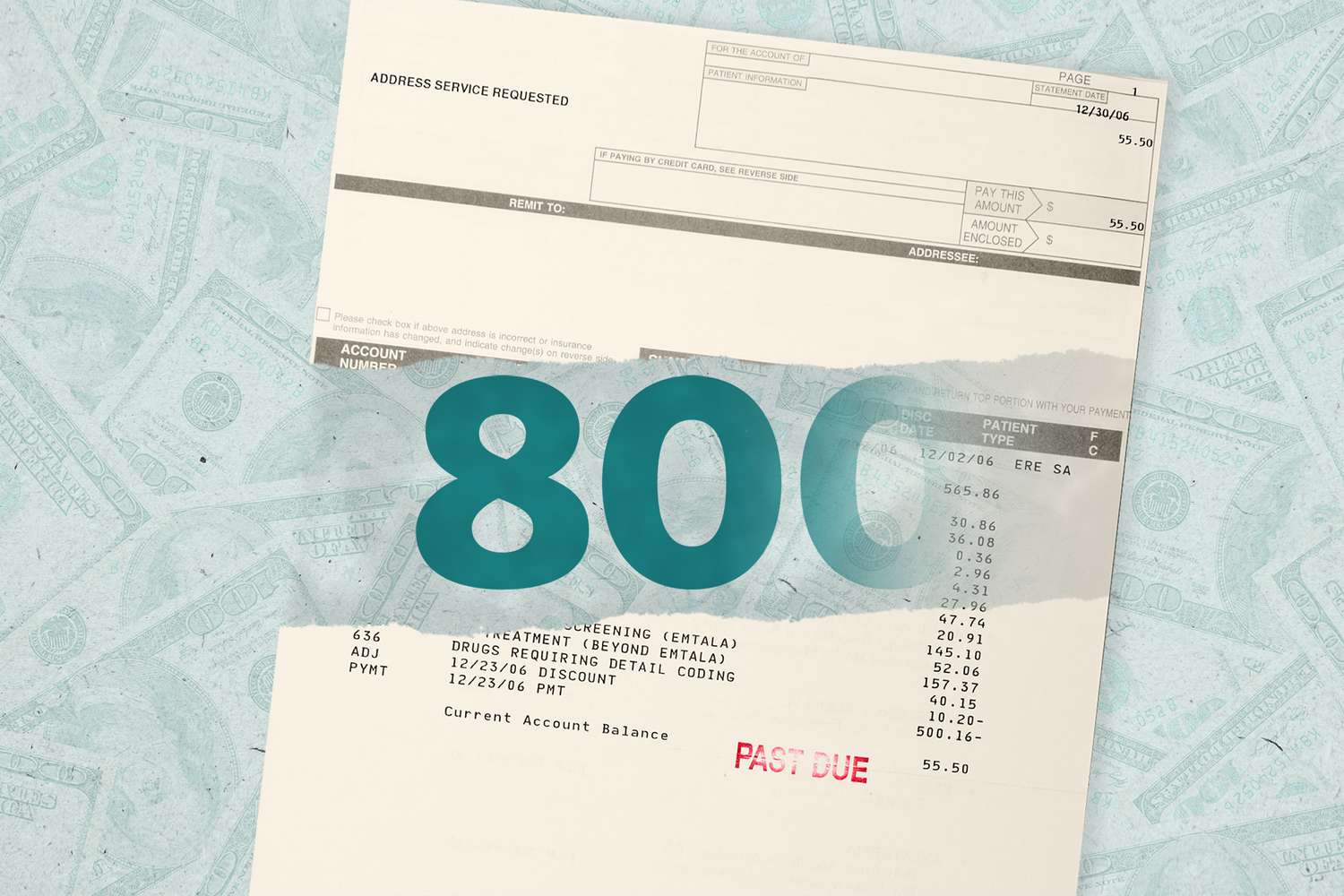

Bad Credit? Medical debt could soon be barred from ruining your credit score

The Biden administration announced a major initiative to protect Americans from medical debt on Thursday, outlining plans to develop federal rules barring unpaid medical bills from affecting patients’ credit scores.

The regulations, if enacted, would potentially help tens of millions of people who have medical debt on their credit reports, eliminating information that can depress consumers’ scores and make it harder for many to get a job, rent an apartment, or secure a car loan.

New rules would also represent one of the most significant federal actions to tackle medical debt, a problem that burdens about 100 million people and forces legions to take on extra work, give up their homes, and ration food and other essentials, a KFF Health News-NPR investigation found.

“No one in this country should have to go into debt to get the quality health care they need,” said Vice President Kamala Harris, who announced the new moves along with Rohit Chopra, head of the Consumer Financial Protection Bureau, or CFPB. The agency will be charged with developing the new rules.

“These measures will improve the credit scores of millions of Americans so that they will better be able to invest in their future,” Harris said.

Enacting new regulations can be a lengthy process. Administration officials said Thursday that the new rules would be developed next year.

Such an aggressive step to restrict credit reporting and debt collection by hospitals and other medical providers will also almost certainly stir industry opposition.

At the same time, the Consumer Financial Protection Bureau, which was formed in response to the 2008 financial crisis, is under fire from Republicans, and its future may be jeopardized by a case before the Supreme Court, whose conservative majority has been chipping away at federal regulatory powers.

But the move by the Biden administration drew strong praise from patients’ and consumer groups, many of whom have been pushing for years for the federal government to strengthen protections against medical debt.

“This is an important milestone in our collective efforts and will provide immediate relief to people that have unfairly had their credit impacted simply because they got sick,” said Emily Stewart, executive director of Community Catalyst, a Boston nonprofit that has helped lead national medical debt efforts.

Credit reporting, a threat designed to induce patients to pay their bills, is the most common collection tactic used by hospitals, a KFF Health News analysis has shown.

“Negative credit reporting is one of the biggest pain points for patients with medical debt,” said Chi Chi Wu, a senior attorney at the National Consumer Law Center. “When we hear from consumers about medical debt, they often talk about the devastating consequences that bad credit from medical debts has had on their financial lives.”

Although a single black mark on a credit score may not have a huge effect for some people, the impact can be devastating for those with large unpaid medical bills. There is growing evidence, for example, that credit scores depressed by medical debt can threaten people’s access to housing and fuel homelessness in many communities.