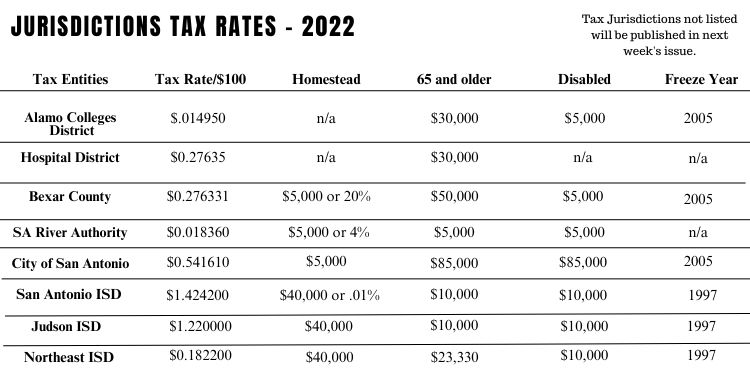

2022 Tax Jurisdiction Rates

The deadline for 2022,’s tax payments has already passed and those homeowners, who have already paid those taxes, are eligible to protest the appraised value of their property.

The accompanying research (shown in infographic) reflects 2022 tax rates and exemptions for various jurisdictions.

When reading the 2022 tax rates:

-Homestead is the “exemption”, granted to homeowners whose property is their principal residence.

-‘N/a’ refers to ‘non applicable’ as some jurisdictions do not grant reductions.

-The Freeze year is the year when some entities began freezing exemptions – homestead, disabled and sixty-five and older.

What does this mean for homeowners? In simple terms pay attention to tax rates of entities who keep raising their rates while others have frozen their rates. Tax jurisdiction rates are in addition to the market value of your home.

The City of San Antonio only decides on its own tax rates and is not involved in rates set by other jurisdictions, i.e. school districts, ACCD etc. They only have input on municipal entities. While many think your property taxes solely rely on your home value, the truth is the taxing jurisdictions play a bigger part of what your property tax bill will be at the end of the tax year. The higher the home value the higher the payment to local taxing jurisdictions whose percentage rates are shown here in the info chart.

For example if your home’s market value is $260,000 the taxing jurisdictions percentage rates take their percentages of your home’s value based on their rate applied to your home value and when you add them all up it becomes a hefty bill.

While most of us look to our left and right at high valued homes in our area that show our market value will rise due to those rising values, we rarely look to the taxing jurisdictions rates that play a huge part in our property taxes.

Property taxes can be overwhelming and hard to understand. Future references will be made to the role of the Texas Comptroller’s Office, in directing the setting of tax rates, as well as voter approval input with various taxing entities.

We will be following up, in the next column, with rates for a number of additional cities and area school districts.