The calendar yesterday for ‘all things regarding property values and subsequent taxes’ continued to move forward as the Appraisal districts have now completed appraisals, sent out notices of value and processed applications for exemptions.

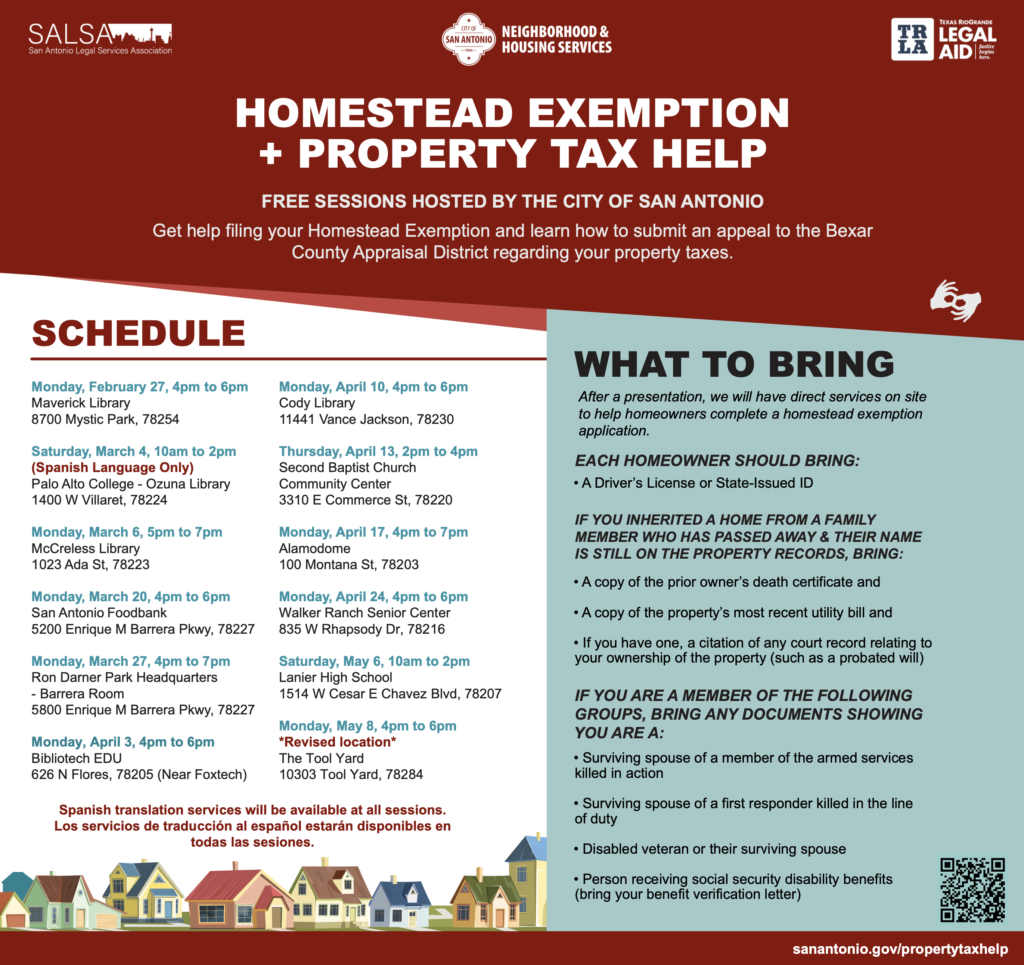

The deadline for filing a protest, of the appraised value of a property, is May 15, 2023. More information about how to protest property taxes is below.

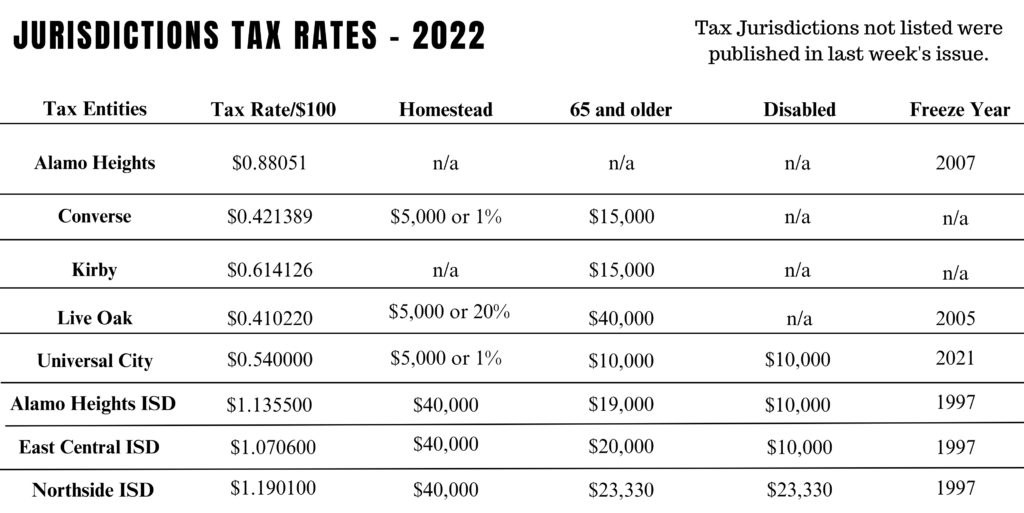

Last week we covered tax rates for some jurisdictions which you can read here.

Here’s more on some of the rates, for some cities and school districts in Bexar County:

In 2021, the state of Texas, 50.57% of the state’s collected tax revenue came from property taxes.

The Comptroller’s office also plays a major role in advising jurisdictions on tax rates and we will continue to delve into that role going forward.