By: Gordon Benjamin

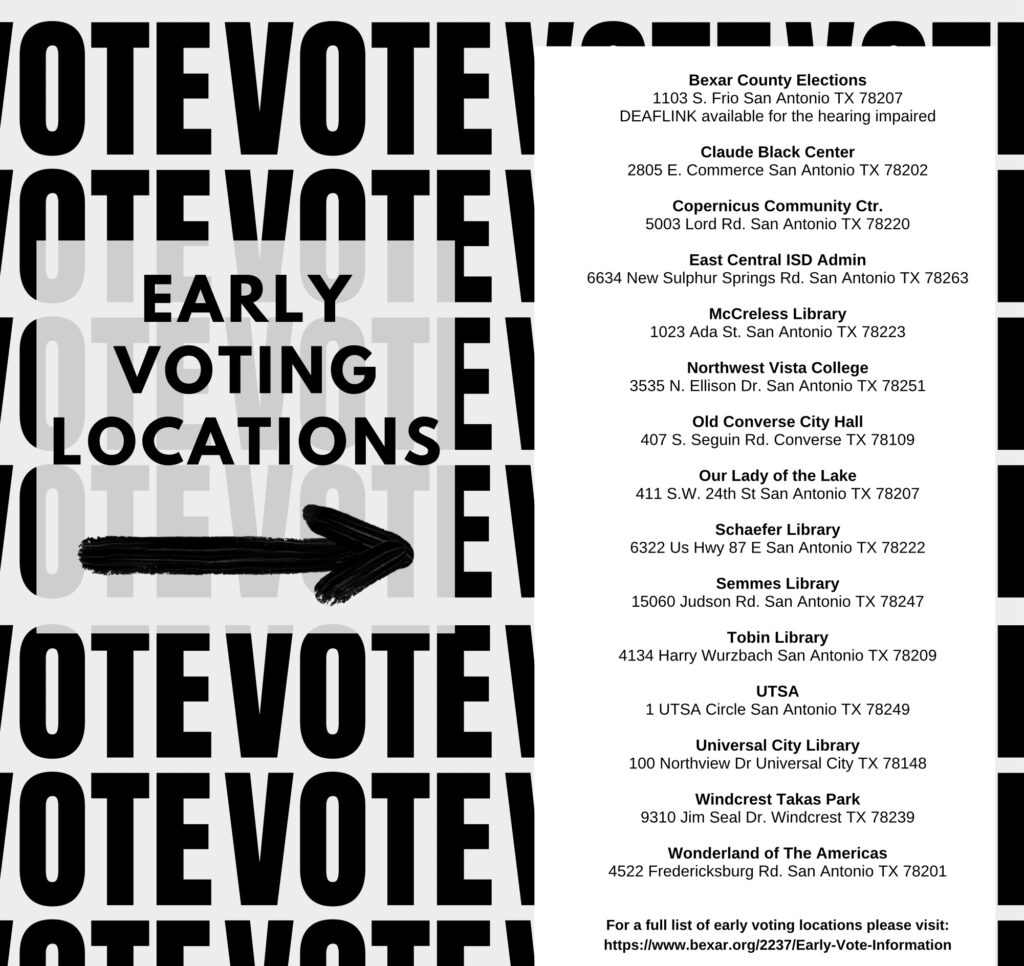

From October 23 through November 3, 2023, early voting will be taking place regarding the addition of fourteen amendments, focusing on property tax cuts and amendments to the state Constitution. Election Day is November 7, 2023.

According to a Constitutional Law professor, at Texas A&M University, “in Texas” constitutional amendments are very powerful and have the ability to “sort of enshrine a policy for a long time.” For this reason, we are bringing readers a weekly synopsis of the Amendments language and what each amendment ‘actually’ means. Next week we will dive into more amendments that will be on your ballot.

The amendments vary across multiple subjects; several will create new state funds, others will deal with property taxes and two apply only to two specific counties.

The billions, in property tax cuts, need Texas’s voters approval, before taking effect. Additional perspective on the remaining ten amendments are forthcoming. We hope readers will benefit from the upcoming information, as well.

AMENDMENTS EXPLAINED (Additional information on the remaining ten amendments are forthcoming)

Proposition 4

Proposed: A state constitutional amendment to authorize the Legislature to establish a temporary limit on the maximum appraised value of real property, other than a residence homestead for ad valorem tax purposes; To increase the amount of exemption from ad valorem taxation, by a school district, applicable to residence homestead from $40,000 to $100,000. Running for 2nd term

To adjust the amount of the limitation on school district ad valorem taxes imposed on the residence homestead of the elderly or disabled to reflect increases in certain exemption amounts; to accept certain appropriations to pay for ad valorem tax relief.

To authorize the Legislature to provide for a four – year term of office for a member of the board of directors of certain appraisal districts.

What This Means: Proposition 4 increases the Homestead Exemption from $40,000 to 100,000. Requires that a non – homestead property’s value not be increased more than 20% compared to the previous year. It would send money, approved by the Legislature, to School districts to replace lost tax revenues. It would require that counties, with a population of 75,000 or more, allow voters to elect three members of a nine member Appraisal board.

Proposition 7

Proposed: A Constitutional Amendment providing for the creation of the Texas Energy Fund, to support the construction, maintenance, modernization and operation of electric generating facilities.

What This Means: This grants the state the right to create an Energy Fund. The Texas Legislature would put monies into the fund, which would then be used by the Public Utility Commission to provide loans or grants, to build or upgrade electricity plants in Texas.

Proposition 8

Proposed: A Constitutional Amendment creating a broadband infrastructure fund to expand high – speed broadband access and assist in the financing of connectivity projects.

What This Means: The amendment would create a $5 billion broadband infrastructure fund. Money in the fund would be used for investments in high – speed internet projects. Fund would be terminated in 10 years.

Proposition 9

Proposed: An amendment authorizing the 88th Legislature to provide a cost – of – living adjustment to certain annuitants of the Teacher Retirement System of Texas.

What This Means: There is a constitutional limit on state spending. This year, the state legislature approved cost – of – living adjustments and a one – time extra payment, to retired teachers, who currently receive retirement or death benefits, from the Teacher Retirement System of Texas. In all, the approved adjustments would cost about $5 billion. The extra payment has already been paid out; This amendment would make it constitutional to make the cost – of – living adjustments, despite such payments exceeding the constitutional limit on state spending.